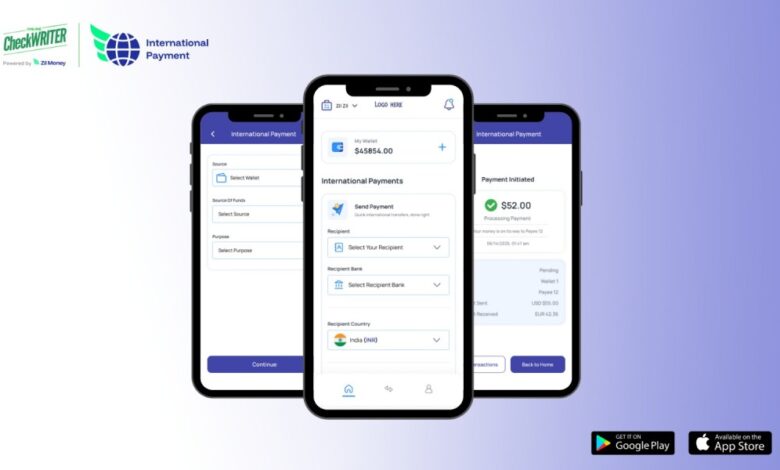

Discover the New International Payment App for SMBs

OnlineCheckWriter.com – Powered by Zil Money’s New International Payment App makes global business as seamless as local in minute-speed technology

You know, the line between local and global is disappearing, and in today’s world, time really is money. More SMBs are now paying overseas suppliers, hiring remote talent, and expanding into new markets—all from their phones.

Today, more than ever, SMBs are diving into cross-border e-commerce, working with international suppliers, and tapping into global talent pools—making seamless global payments a business necessity, not a luxury.

Imagine sending funds from Houston to Paris instantly on your mobile, with zero pre-funding and real-time confirmation. The new International Payments Mobile App (Available on Android and iOS) delivers fast international payments, aligning perfectly with this future and setting a new standard for global payments that matches the speed of commerce and the expectations of modern entrepreneurs.

Why Mobility Globally Matters

Smartphones have become financial command centers. Countries like India leapfrogged decades of legacy infrastructure by embracing domestic payment, while global cashless payments hit record highs.

As super apps rise, SMB leaders benefit from seamless multi-currency transactions, live exchange rates, and instant notifications—features that mirror the expectations set by consumer apps but tailored for business. Mobile payments are growing at a staggering rate, with global mobile wallet transactions exceeding $10 trillion in 2025, underscoring the shift towards mobile-centric financial management.

In a world where mobility equals productivity, having borderless payments in your pocket unlocks new opportunities, allowing businesses to transact, hire, and settle invoices anywhere, anytime.

The new International Payment App blends instant moves, transparent fee structure, and bank-agnostic settlement—making it the logical next step for businesses that demand agility, reliability, and built-in compliance.

Spotlight: International Payment App Offers

Fast, Borderless Transfers: Process payments in minutes, whether it is to Europe or APAC—no wire delays or intermediary bottlenecks.

No Pre-Funding Hassles: Pay directly from your wallet without tying up capital or prefunding international banks.

Multi-Currency and Live FX: Move, hold, and convert funds in major and emerging currencies with full visibility on exchange rates.

Transparent, Predictable Fees: Clear sender-side fee structure—recipients get exactly what’s promised without hidden fees, aiding budgeting and trust.

Bank-Grade Security: Encrypted transactions, advanced fraud detection, multi factor authentication and regulatory compliance built in.

Business-Friendly UI: Designed for SMBs of all sizes, the app offers an intuitive, clutter-free interface that makes managing payments simple and hassle-free—no tech expertise needed

Built for Tomorrow

As SMBs scale beyond borders, adaptability is key. The International Payment App is architected for global expansion—compliance checks mean businesses can expand into new regions without retooling. Multi-country design principles keep you future-proof. With constant upgrades—the app is ready to evolve with changing regulations and user needs, ensuring SMBs never fall behind.

Global commerce no longer requires global offices—just global apps. OnlineCheckWriter.com – Powered by Zil Money’s International Payment App reimagines mobile as your global currency, making business everywhere as easy as business anywhere. It’s not only about payments—it’s about unlocking new markets, new talent, and new opportunities. This empowerment translates into faster cash flow cycles, expanded customer bases, and the ability to scale without the traditional headaches of cross-border finance.

As mobile transforms every sector, this app stands at the wave’s crest, giving SMBs the power to thrive in a truly borderless digital economy. Ready to join the future of borderless payments?

Download the International Payment App now—available on Android and iOS—and discover how mobile-enabled global payments can transform your business today.

FAQ

Q1: How quickly can I send payments internationally with this App?

With the International Payment app, you can send payments globally in minutes—often in as fast as 90 seconds—making cross-border transactions efficient and timely.

Q2: Do I need to pre-fund an account before making an international payment?

No, the International Payment app lets you make global transactions instantly without the need to pre-fund, saving you time and freeing up working capital.

Q3: Is the app secure for handling sensitive payment information?

Absolutely. The International Payment app uses bank-grade encryption and advanced fraud detection to keep your transactions and data safe at all times.