Fast International Payments & the New Mobile App from OnlineCheckWriter.comô – Powered by Zil Money.

For many small and mediumãsized U.S. businesses, paying overseas vendors and contractors used to mean juggling multiple platforms, uncertain exchangeô ratesô and days of waiting for money to arrive.ô Fast international paymentsô are now essential for keeping projects on schedule and cash flow healthy. That need has inspired OnlineCheckWriter.com ã Powered by Zil Money to launch a dedicated mobile app that puts global transfers in the palm of your hand.

Why Traditional Methods Still Hurt Small Businesses

Even in a digital age, sending money abroad can feel like a throwback. Hidden markups and fees make costs unpredictable, transfers vanish into a chain of intermediaries, and compliance rules vary by country.ô More thanô halfô of large corporate clients complain about slow settlement times,ô andô anô 11 %ô failure rate in crossãborder transactions cost U.S. eãcommerce firmsô $3.8billion in 2023.

These problemsô donãtô just affect big companies. A Federal Reserve survey found that roughlyô fourô of every fiveô smallô firms face payment challenges; those collecting through third parties report delays as their biggest obstacle. When small businesses depend on global contractors and suppliers, outdated payment systems can stall innovation and erode trust.

A MobileãFirst Approach for SMBs

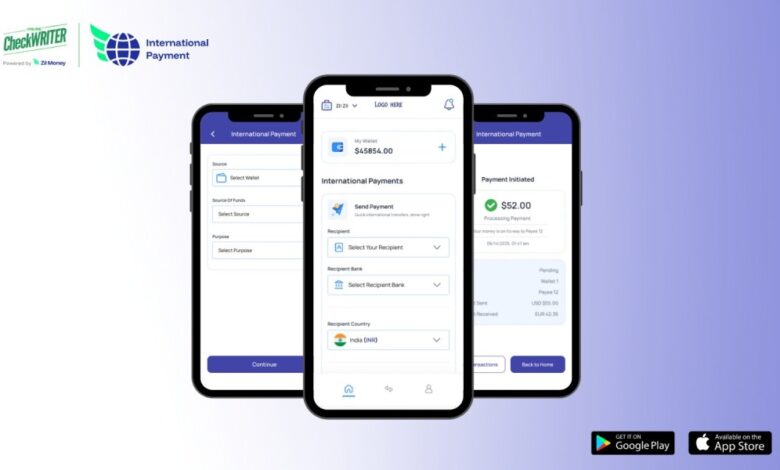

Recognizing these struggles, OnlineCheckWriter.com ã Powered by Zil Money built a new international payment app that simplifies every step of the process. Instead of logging into multiple websites or waiting on calls with service providers, business owners can send money overseas in just a few taps. Designed with usability in mind, the app makes crossãborder transfers feel as easy as paying a local vendor.

Imagine a marketing firm in Seattle hiring a graphic designer in Tallinn. Previously, the firm might have wired money through a legacy system, paying high fees and waiting days for confirmation. With the new app, the manager chooses the recipient, enters the amount, selects theô currencyô and sees the total costãno surprises. The designer in Estonia receives the full amount within minutes, so project momentum never slows.

Features That Matter

ãÂô Transfers in minutes:ô Payments arrive in a fraction of the time keeping projects on track and partners happy.

ãÂô No preãfunding hassles:ô Traditional systems often require loading money into foreign accounts. The new app lets users send funds directly from a digital wallet,ô freeing up cash flow.

ãÂô Multiãcurrency options:ô Businesses can choose whether to pay in U.S. dollars or local currency. Live, transparent exchange rates ensure that everyone gets paid fairly.

ãÂô Clear, upfront fees:ô Hidden charges erode trust. The app shows fees before you confirm, and senders cover theô costso recipients receive the full payment.

ãÂô Mobile convenience:ô Built for iOS and Android,ô itãsô easy to manage international transfers on the go.ô Whetherô youãrevisiting clients or checking inventory, you can send money from anywhere.

ãÂô 24/7 access:ô Businessô doesnãtô stop when offices close. Payments can be sent at any hour, including nights,ô weekendsô and holidays, so your global operationsô donãtpause.

ãÂô Enterpriseãlevel security:ô Every transaction uses strong encryption and fraud monitoring.ô Multiãfactor authentication protects accounts, giving users confidence that their data and funds are safe.

ãÂô All-in-one platform:ô The appô isnãtô limited to international transfers. It also supports checks,ô ACHô and wires, letting businesses manage multiple payment methods from a single dashboard.

How the App Supports U.S. SMBs

This mobile solution is designed for the doers of the business world: freelance designers in Europe, U.S. agencies paying remote developers, startups sourcing products overseas and consultants providing crossãborder service. By eliminating waiting periods and making costs transparent, the app helps small firms build stronger relationships with international partners and keep work flowing. Faster payments mean happier freelancers and suppliers, betterô collaborationô and more time to focus on growth.

Looking Ahead: The Future of Mobile CrossãBorder Payments

Payment technology is evolving quickly. APIs are delivering upãtoãtheãminute foreign exchange rates and automation,ô while distributed ledger technology reduces reliance on intermediaries and lowers costs.ô Artificial intelligence is improving fraud detection and risk assessment,ô and instant settlement networks are linking domestic systems worldwide. Industry research forecasts that crossãborder instant payment transactions will increase by more thanô two hundred percentô by 2028.

Adopting a mobileãfirst international payment solution positions SMBs toô benefitô from these innovations. When your business can send funds globally in minutes with full visibility, you gain agility. You can respond to opportunities quickly, build trust with global partners and compete on a global stage without the hurdles of outdated infrastructure.

The next step

Donãtô let outdated payment methods slow your business down. Discover how the new international payment app from OnlineCheckWriter.com ã Powered by Zil Money can makeô fast international paymentsô truly effortless.ô

Download it from theô App Storeô orô Google Playô Storeô and experience the difference of transparent pricing, mobileô convenienceô and lightningãfast transfers.

FAQs

1.ô Is the international payment app available on both iPhone and Android?

Yes. The app can be downloaded from the App Store and Google Play Store.

2.ô Do I need to preãload money into a foreign account?

No. You can send payments directly from your digital wallet without preãfunding.

3.ô Can I choose which currency to pay in?

Absolutely. You can select U.S. dollars or local currency with live exchange rates, ensuring partners receive fair amounts