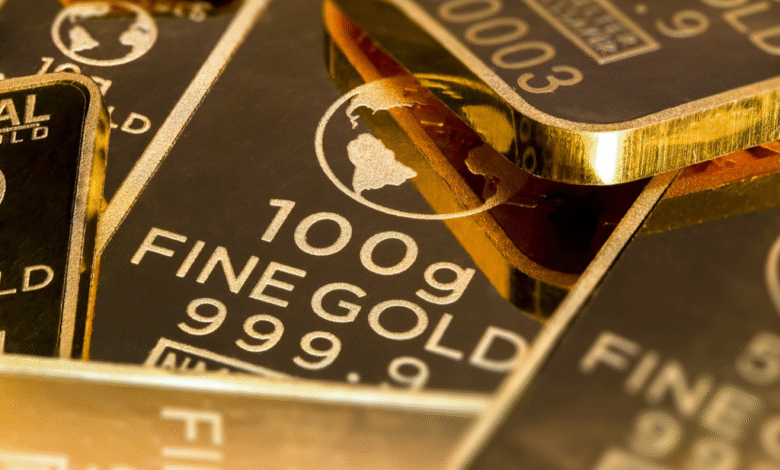

Gold tops $3,300 for the first time amid escalating US-China trade war

Gold prices extended their historic rally on Wednesday, breaching the $3,300 per ounce mark, driven by a weaker US dollar and rising tensions between the United States and China.

As of 10:52 a.m. ET (1452 GMT), spot gold had jumped 2.5% to $3,308.17 an ounce after reaching a record high of $3,319.17 earlier in the trading session.

As the conflict escalates, the US dollar is coming under significant pressure, with investors increasingly seeking safety in assets such as gold

Heightened global risks drive demand

A video circulating on social media has drawn attention to the growing presence of African nationals in the Russia-Ukraine war, raising fresh concerns about foreign recruitment and the risks facing journalists investigating such activities.

Ghana’s efforts to diversify its mineral resource base have received a major boost, as preliminary exploration in the Oti Region points to commercially viable iron ore deposits.

Gold prices extended their historic rally on Wednesday, breaching the $3,300 per ounce mark, driven by a weaker US dollar and rising tensions between the United States and China.

The surge in gold prices reflects growing unease surrounding global economic stability. With geopolitical tensions mounting and financial markets jittery, investors are turning to gold as a reliable store of value.

READ MORE: IMF justifies Ghana’s utility tariff hikes as necessary for energy sector reform

This momentum has been bolstered by mounting speculation that the US Federal Reserve may adopt more aggressive monetary policy easing, in response to persistent inflation and signs of slowing economic growth.

Weaker dollar boosts global gold demand

A declining US dollar has further fuelled gold’s appeal. As the greenback weakens, gold becomes more affordable for buyers holding other currencies, thereby increasing global demand for the metal.

Market watchers are also keeping a close eye on forthcoming economic data and any potential developments in the ongoing trade row, which could influence the US Federal Reserve’s policy stance and shape the future direction of gold prices.

In a move that further strained US-China relations, President Donald Trump on Tuesday ordered an investigation into imposing tariffs on all US critical mineral imports. The decision is seen as an effort to exert additional pressure on China and has rattled financial markets.

The renewed friction between the world’s two largest economies has diminished broader market sentiment, compelling investors to retreat into safe-haven assets like gold.

The US dollar, meanwhile, slipped to near a three-year low, making gold even more attractive for non-dollar holders.

Gold’s impressive 2025 rally

READ MORE: Ghana’s iron ore prospects in Oti region show great promise

Gold has already gained nearly $700 in value this year, fuelled by a combination of trade disputes, expectations of looser monetary policy, and robust central bank purchases.

Investors are now awaiting a speech later today from US Federal Reserve Chair Jerome Powell, hoping to glean further insight into the central bank’s stance on future interest rates.

In parallel with gold’s climb, spot silver rose by 1.5% to $32.75 an ounce. Platinum saw a 1% gain, reaching $968.53, while palladium edged up 0.3% to $974.20.