Gov’t scraps COVID-19 levy, injects GHC 3.7bn into economy

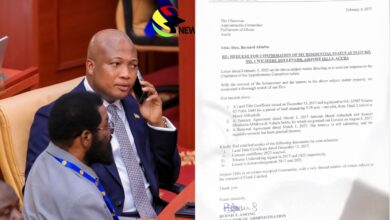

Finance Minister Dr Cassiel Ato Forson has unveiled sweeping tax reforms, led by the abolition of the COVID-19 Health Recovery Levy during the presentation of the 2026 Budget Statement, which

The levy, introduced during the pandemic, had long been criticized for inflating costs for consumers and businesses. Its removal, Dr. Forson said, will return GH₵3.7 billion to Ghanaians in 2026 alone.

“By abolishing the COVID-19 levy, Government is putting GH₵3.7 billion in the pockets of individuals and businesses,” he told Parliament.

The move forms part of a broader VAT overhaul expected to channel GH₵5.7 billion in total relief to the private sector and households. Among the key reforms are the reinstatement of input tax deductions on GETFund and NHIL levies, a reduction of the effective VAT rate from 21.9% to 20%, and an increase in the registration threshold from GH₵200,000 to GH₵750,000.

Additionally, VAT on mineral reconnaissance and prospecting has been scrapped, while zero-rating for locally manufactured textiles has been extended to 2028.

Dr. Forson said the measures are aimed at easing the cost of doing business, boosting disposable incomes, and stimulating growth after years of fiscal tightening.