Key Players & Market Dynamics

The global carbon credit market has evolved into a multi-billion dollar industry driven by increasing corporate commitments to sustainability and stricter regulatory frameworks. Market projections indicate growth from approximately $933 billion in 2025 to over $16 trillion by 2034, reflecting the urgent need for scalable climate solutions. As businesses navigate their decarbonization pathways, understanding the diverse ecosystem of carbon credit companies becomes essential for making informed investment and procurement decisions. This market encompasses both compliance and voluntary segments, each serving distinct roles in global emission reduction efforts.

The Growing Carbon Credit Market Landscape

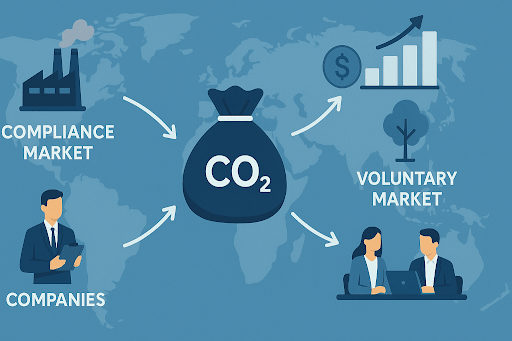

Carbon credit markets operate through two primary channels: compliance markets mandated by government regulations and voluntary markets where companies proactively offset emissions. The compliance segment, dominated by systems like the EU Emissions Trading Scheme, accounted for 98.8% of market share in 2023. However, the voluntary market is experiencing rapid expansion, projected to reach between $7 billion and $35 billion by 2030.

This growth is fueled by over 2,700 companies that established Science Based Targets initiative commitments in 2024 alone, representing a 65% increase from the previous year. These net-zero pledges create sustained demand for high-quality carbon credits as organizations seek to compensate for residual emissions they cannot eliminate through operational improvements. The market serves multiple end-use sectors, with power generation, aviation, and industrial manufacturing leading adoption rates.

Geographic distribution shows Europe maintaining market leadership due to the mature EU ETS infrastructure, while Asia-Pacific markets are expanding rapidly following policy developments in India and China. North America’s voluntary market represents 37% of global activity, driven by corporate sustainability initiatives.

Types of Carbon Credit Providers and Their Roles

The carbon credit ecosystem includes several distinct player categories, each fulfilling specific functions within the value chain. Understanding these differences helps organizations select appropriate partners for their decarbonization strategies.

Marketplace Platforms vs. Project Developers

Carbon credit companies operate across different business models that serve complementary functions:

- Marketplace Platforms facilitate transactions between buyers and sellers, offering digital infrastructure for credit discovery, verification, and retirement through exchange services with emphasis on transparency.

- Project Developers originate carbon credits by implementing emission reduction or removal projects spanning renewable energy, forestry conservation, and methane capture initiatives across multiple geographies.

- Specialized Brokers provide procurement advisory services, helping corporate buyers navigate quality assessments and portfolio construction while maintaining relationships with project developers and verification bodies.

- Technology Providers focus on engineered carbon removal solutions, including direct air capture and biochar production, addressing growing demand for permanent carbon removal credits.

Major players including South Pole Group, 3Degrees, EKI Energy Services, Finite Carbon, and NativeEnergy span multiple categories, offering integrated services from project development through credit retirement. This consolidation trend reflects market maturation as buyers seek streamlined procurement processes.

Project Types and Verification Standards

Carbon credits originate from two fundamental project categories: avoidance or reduction projects that prevent emissions from entering the atmosphere, and removal or sequestration projects that extract existing carbon dioxide. Avoidance and reduction projects accounted for 66.45% of market revenue in 2023, primarily consisting of renewable energy installations, forest conservation programs, and energy efficiency improvements.

Nature-Based vs. Technology-Based Solutions

Nature-based removal includes reforestation and afforestation programs, soil carbon storage through regenerative agriculture, mangrove and seaweed restoration in coastal ecosystems, and peatland protection initiatives. Technology-based removal encompasses direct air capture facilities, biochar production systems, and enhanced weathering applications. While these solutions typically command premium pricing due to higher development costs, they offer greater permanence and measurability advantages.

The cap-and-trade approach to emissions reduction has proven effective across multiple jurisdictions, establishing clear frameworks for credit generation and trading. Organizations like Climeworks and Charm Industrial are pioneering scalable technological approaches that complement nature-based portfolios.

Quality verification remains paramount as buyers increasingly scrutinize credit integrity. Key assessment criteria include:

- Additionality: Projects must demonstrate emissions reductions beyond business-as-usual scenarios

- Permanence: Carbon storage must be maintained over extended timeframes with reversal risk mitigation

- Leakage Prevention: Projects should not shift emissions to other locations or activities

- Independent Verification: Third-party validation from accredited bodies ensures methodology compliance

The Integrity Council for the Voluntary Carbon Market has introduced Core Carbon Principles to standardize quality assessments, while rating agencies provide independent project evaluations. These developments address historical concerns about credit quality that temporarily cooled market activity in 2024.

Market Outlook and Investment Considerations

The carbon credit market is positioned for significant expansion as regulatory frameworks tighten and corporate accountability intensifies. The aviation sector faces imminent compliance requirements through CORSIA implementation, with deadlines beginning in 2027. Carbon emission trading under the Paris Agreement establishes international frameworks for credit trading between nations, potentially unlocking substantial new demand streams.

Several factors will shape market evolution through 2030. Regulatory expansion continues as more jurisdictions implement compliance schemes beyond current systems. Markets are shifting toward removal credits, expected to represent 35% of transactions by 2030 as buyers prioritize permanent carbon sequestration. Technology maturation enables engineered removal solutions to achieve scale, with companies securing multi-year offtake agreements.

Organizations entering the market should evaluate providers based on project portfolio diversity, verification rigor, and transparent pricing structures. Due diligence should examine whether companies focus on compliance versus voluntary markets, their geographic coverage, and their capacity to deliver credits aligned with corporate sustainability frameworks.

Investment approaches vary from purchasing individual project credits to constructing diversified portfolios that balance cost, quality, and co-benefit considerations. Forward contracts enable price hedging while supporting project development financing.

Key market insights for strategic positioning:

- Carbon credit demand will increasingly shift from avoidance to removal projects as companies progress toward net-zero deadlines

- Technology-based removal solutions will scale significantly but remain premium-priced relative to nature-based alternatives

- Market infrastructure improvements through digital platforms and standardized protocols will enhance transaction efficiency

- Quality differentiation will intensify, creating pricing tiers based on project characteristics and verification standards

The carbon credit ecosystem continues evolving from a nascent offset mechanism into a sophisticated financial market supporting global decarbonization. Organizations that develop informed procurement strategies and partner with credible providers will position themselves advantageously as regulatory requirements expand and stakeholder expectations intensify around climate accountability.