Top 10 weakest African currencies in 2025

Money is more than just paper or coins. It represents the strength of a country’s economy and the confidence people have in it. In Africa, where many nations rely heavily on imports, the strength or weakness of a local currency can make a huge difference in people’s daily lives.

From the cost of food and fuel to school fees and rent, a weak currency often means paying more for the same things.

In 2025, several African countries are still grappling with currency depreciation, driven by a mix of inflation, political instability, poor economic planning, and global pressures.

A weak currency means it takes more of your local money to buy goods priced in stronger currencies like the US dollar, which is bad news for anyone trying to make ends meet.

Manchester City and Belgium national team player Jeremy Doku is in Ghana and has been captured playing community football with locals on a dusty pitch. Watch as he attempts a fancy trick on an opponent…

This list of the Top 10 weakest African currencies in 2025 is based on exchange rates obtained using the Forbes currency calculator as of Tuesday, 15 July. These rankings show how many units of each currency equal one US dollar, the more units it takes, the weaker the currency is considered.

Whether you’re a student, entrepreneur, or just financially curious, understanding these rankings can help you see how your country stacks up, and why economic stability matters for your future.

Weakest African Currencies:

1. Sierra Leonean Leone (SLL)

Exchange Rate: 1 USD = 20,969.5 SLL

The Sierra Leonean Leone remains one of Africa’s most devalued currencies, requiring over 20,000 units to equal one US dollar. Despite rich mineral resources including diamonds and iron ore, the country faces challenges with infrastructure deficits, high inflation, and limited export diversification. Political instability and weak governance structures continue to undermine investor confidence.

2. Guinean Franc (GNF)

Exchange Rate: 1 USD = 8,681.20 GNF

Guinea’s currency weakness persists despite the country’s substantial mineral wealth, including significant bauxite reserves. Political instability, poor infrastructure, and limited economic diversification prevent effective resource utilization. The informal market often shows significant deviation from official exchange rates, indicating underlying economic stress.

ALSO READ: Top 10 strongest currencies in Africa in April 2025

3. Ugandan Shilling (UGX)

Exchange Rate: 1 USD = 3,586.89 UGX

The Ugandan Shilling faces pressure from declining remittances, widening trade deficits, and inflationary pressures. While Uganda has initiated various infrastructure projects to stimulate economic growth, their impact on currency stabilization remains limited. The Bank of Uganda maintains relatively high interest rates to combat inflation.

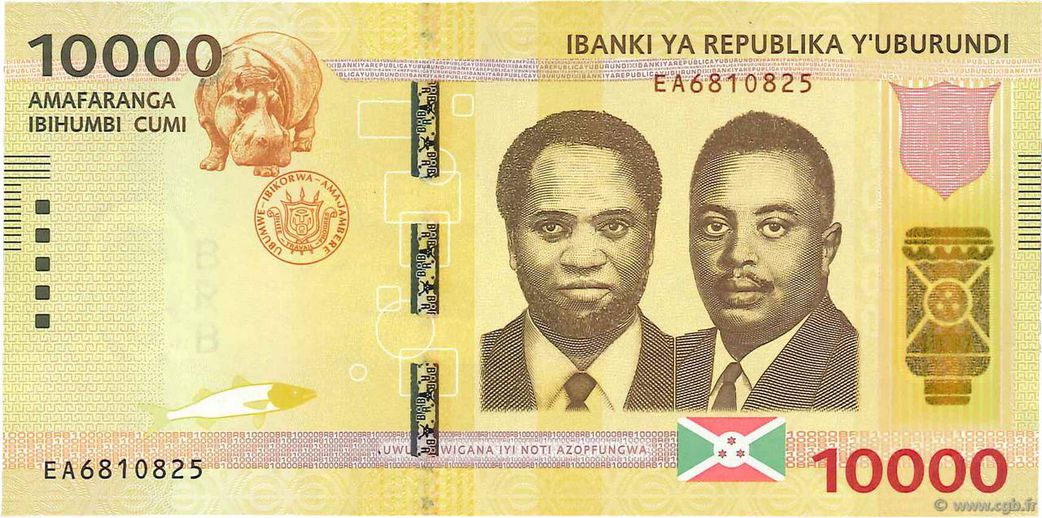

4. Burundian Franc (BIF)

Exchange Rate: 1 USD = 2,985.49 BIF

Burundi’s currency reflects the country’s economic isolation and limited industrialization. Heavy reliance on external aid, low export earnings, and ongoing political tensions contribute to the franc’s weakness. The currency remains one of the least-traded in international markets, with limited liquidity.

ALSO READ: Bill Gates slips out of top 10 richest people in the world – See latest rankings

5. Congolese Franc (CDF)

Exchange Rate: 1 USD = 2,913.53 CDF

Despite the Democratic Republic of Congo’s vast mineral wealth, ongoing conflicts, governance issues, and infrastructure challenges prevent economic stability. The currency’s weakness reflects the country’s struggle to attract sustained foreign investment due to legal uncertainty and security concerns.

ALSO READ: Here’s the country with the most worthless currency in the world

6. Tanzanian Shilling (TZS)

Exchange Rate: 1 USD = 2,614.29 TZS

The Tanzanian Shilling has shown some resilience compared to regional peers but still faces challenges from rising import costs and limited foreign exchange reserves. The Bank of Tanzania actively intervenes in forex markets to manage volatility, though structural economic issues persist.

ALSO READ: 5 most beautiful currency in the world

7. Malawian Kwacha (MWK)

Exchange Rate: 1 USD = 1,735.20 MWK

Malawi’s currency reflects persistent trade imbalances and heavy dependence on donor aid. The country devalued the Kwacha by over 40% in 2023 to secure IMF support, highlighting the severity of its fiscal challenges. Limited foreign direct investment continues to pressure the currency.

ALSO READ: 10 most valuable currencies in the world

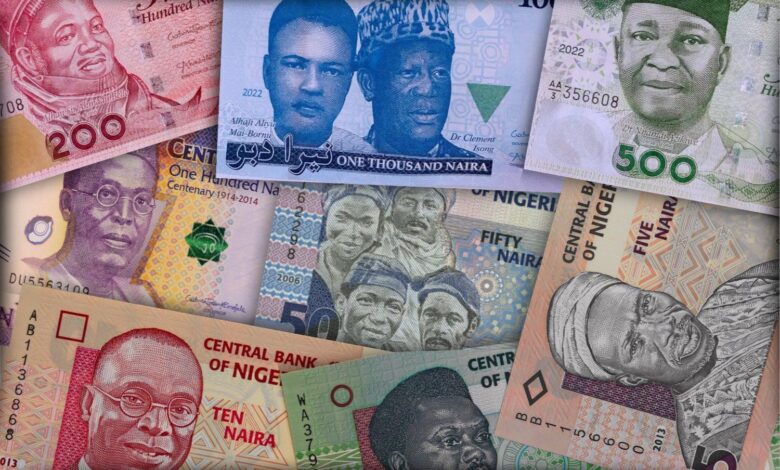

8. Nigerian Naira (NGN)

Exchange Rate: 1 USD = 1,531.92 NGN

The Nigerian Naira’s weakness stems from foreign exchange shortages, declining oil revenues, and recent policy reforms including fuel subsidy removal. The Central Bank’s multiple exchange rate windows create significant gaps between official and parallel market rates, reflecting underlying economic stress.

9. Rwandan Franc (RWF)

Exchange Rate: 1 USD = 1,445.98 RWF

Rwanda’s currency has depreciated against regional currencies despite the country’s relatively stable political environment. The government maintains a managed float regime and uses targeted interventions to prevent excessive depreciation, though regional economic pressures continue to impact the franc.

ALSO READ: Is Africa ready for cryptocurrency? Here’s what you should know

10. Ethiopian Birr (ETB)

Exchange Rate: 1 USD = 137.19 ETB

The Ethiopian Birr faces significant challenges from high inflation, foreign exchange shortages, and ongoing political unrest. Ethiopia’s economy has been severely impacted by internal conflicts. The currency remains overvalued on the official market compared to parallel rates, creating pressure for gradual devaluation.